What Is a Health Insurance Deductible Apex

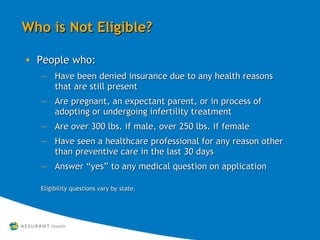

Apex Companies LLC Health Insurance reported anonymously by Apex Companies LLC employees. A HDHP is a health insurance plan with deductible amounts that are greater than 1350 for individual or 2700 for family coverage and have an out-of-pocket maximum that does not exceed 6750 for individual or 13500 for family coverage.

Do You Understand How Insurance Cost Sharing Works

Its line 29 on the 1040 tax form.

. Learn more about plan monthly costpremimum deductiblesprescription drug coverage hospital services accepted doctors and more. Apex Management Group Suite of Affordable Health Care Solutions Schedule of Benefits 100 Preventive Care Services For additional information. Health insurance is not one size fits all its much more detailed than that.

Get Health Insurance plan info on Apex 3000 wCopay P-S Silver from HealthPartners Inc. Individual insurance coverage through the Health Insurance Marketplace. On the shield bar each segment is 25 points of extra health so using shield cells or shield batteries to refill them is very important.

Remember that you will get the highest benefit level and lowest out-of-pocket costs when you see a network provider for your care. If you have other family members on the policy the overall family deductible must be met before the plan begins to pay. A deductible is a component of cost sharing.

For other deductible options and out-of-network costs and deductibles please contact Individual Sales. 1900 individual 3800 family. Account to help guide you and your dependents in your healthcare decisions.

After you pay your deductible you usually pay only a copayment or coinsurance for covered services. Our Affordable Health Care Solutions Include Additional Benefits of the Apex Advantage. If you are self-employed youre allowed to deduct up to your net business income amount for health insurance premium.

Free Preventive Care Low Cost Generic Prescriptions and Dental and Vision Options. A high-deductable health insurance plan has high initial costs for the user until a large threshold typically 5000 is reached. What is high-deductable health insurance.

At Apex Insurance Group we listen to our clients and focus on what they need in order to find the right plan. The APEX preventative care plan complies with the Affordable Care Act mandated preventative care services. With a 2000 deductible for example you pay the first 2000 of covered services yourself.

Why does a person need health insurance. In Apex each character has 100 points of health. Annual Deductible 3000 Ind 6000 Family.

Shull RHU CBC Apex Management Group. In these proposed regulations the IRS takes the position that payments for health care sharing ministry membership sometimes referred to as dues or fees should qualify as health insurance and are deductible. This is primarily for self-employed people.

The amount you pay for covered health care services before your insurance plan starts to pay. Visits must be made in network. What is the health insurance tax deduction.

Usually the higher the deductible the lower the premium will be. For 2022 the minimum deductible on an HDHP is 1400 for an individual and 2800 for a family. Your insurance company pays the rest.

It is administered by Blue Cross Blue Shield of Texas BCBSTX. Please refer to your plan document in Workday for a full description. Ad You May Qualify for the 0 Essential Plan or Other Affordable Health Plans.

There are agencies that can help if you have a complaint against your plan for a denial of a claim. A high-deductible health plan HDHP generally has lower monthly premiums and a higher deductible. A health care sharing ministry is defined as an organization that is exempt under IRC 501c3 whose members share a common set of ethical or religious.

For example if you have a 2000 deductible you must pay that amount before expenses are covered by the insurance company. This plan is also available to qualifying dependents. Lets find the health insurance plan that fits your needs and your budget.

The deductible can be a yearly amount or on a per service basis. 5000 individual 10000 family Generally you must pay all of the costs from providers up to the deductible amount before this plan begins to pay. APEX PLANS BASIC SERVICES.

Your plan may cover 100 of your in-network preventive care before you reach your deductible. This is the amount that a policy holder must pay out of pocket for medical expenses. For more information about the Marketplace visit wwwHealthCaregov or call 1-800-318-2596.

The health pool is supplemented by shields which can add up to 125 extra health when a red Evo Shield is equipped. Many people do not realize that health insurance premiums can be deductible. Apex Capital provides healthcare coverage for all full time employees.

Covered medical expenses are added to or accumulated toward a deductible over the course of a year and then start over the next year. Your premium does not count towards your deductible. The health insurance company will pay the remaining balance.

A health insurance deductible is the amount a consumer has to pay for covered services or medications before their insurance plan starts to pay. What Health Insurance benefit do Apex Companies LLC employees get. What is a health insurance deductible.

Apex Insurance the pinnacle of all your insurance needs. Apex High Deductible High Premium is less expensive but does not cover prescriptions or specialists but does allow for a Health Savings Account. A deductible is the amount of your actual billed health care costs that you must pay before the insurance will kick in.

Some insurance policies require that a deductible be met before coverage begins. Your Grievance and Appeals Rights. Your insurance company can tell you how much of your deductible has been met to date.

No Pre-Existing Conditions No Deductible to meet Great Rates 4-Year Rate Lock Easy Enrollment Platform ACA Compliant Primary Care Visits Specialist Care Urgent Care Laboratory Services Imaging and X-Ray Services Prescription Drugs. See the Apex Rate Guide for more information on eligibility and pricing.

Demystifying Us Health Insurance Health Care Insurance Health Insurance Health Insurance Plans

Insurance Cost Sharing Infographic Insurance Healthcare Deduction Benefit Graphing

Need Short Term Health Insurance

Need Short Term Health Insurance

How To Choose Health Insurance The Right Way Health Insurance Plans Infographic Health Kids Health

Different Types Of Health Insurance Plans

Why Group Health Insurance Isn T Ideal For Small Businesses Infographic Buscar Empleo Redes Sociales Infografia

No comments for "What Is a Health Insurance Deductible Apex"

Post a Comment